It has been proven by data from "Turkey's Top 500 Industrial Enterprises - 2014" that the construction-focused, domestic market-oriented growth path which has been pursued for the past 10 years does not generate any foreign currency and has caused a significant loss of blood in Turkey's manufacturing industry while eroding its competitive power. It has been determined that industry firms are under a heavy debt and interest rate burden.

According to the Istanbul Chamber of Commerce (İSO) and Turkey's Top 500 Industrial Enterprises - 2014, more than half of the real operating income, which is 30 billion Turkish Liras, of the top 500 firms was spent on financing, which corresponded to 16 billion liras.

The share of the real assets of the top 500 companies in total assets fell to 46 percent from 50 percent. The number of companies that are at a loss was 83. The reason losing companies remained at that level was because of their foreign currency positions. With the effect of the mobility in foreign exchange rates and conjuncture factors, certain companies had positive foreign exchange positions; the fall in the profits of the top 500 was compensated.

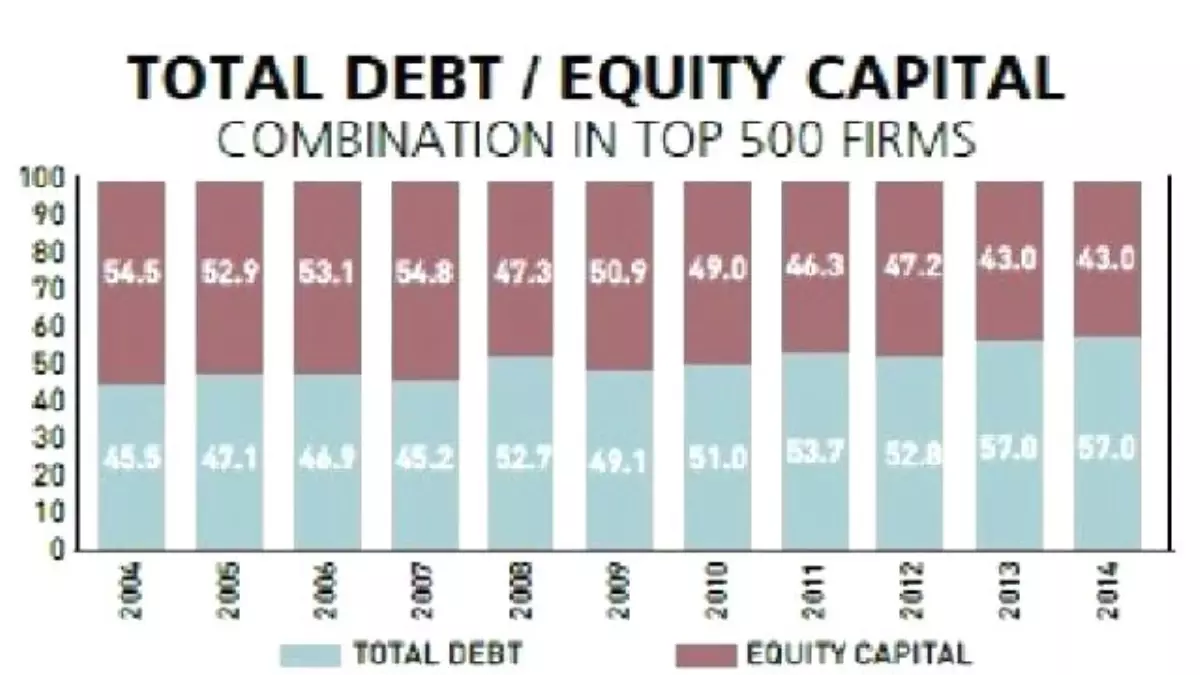

The most important parameter of whether companies had a healthy financial structure was that the ratio of total debt to equity capital remained at its highest level, 132.4 percent, last year.

According to the data of the companies in 2014, the rate of using low-tech was 40 percent while the use of medium-low tech was 37 percent, with the use of medium-high tech at 19 percent and high-tech at 3 percent.

According to the report, the top 500 companies allocated 0.7 percent of their sales for research and development (R&D) costs. The number of enterprises with foreign capital shares fell to 126 in 2014.

Decline

İSO head Erdal Bahçıvan said, based on the findings of the report, there has been a serious decline in the performance of the top 500 industrial enterprises. While the operating profits of companies fell 6.4 percent to 30 billion liras, Bahçıvan said, "What is essential for us is the operational profit of the industrialist. It is concerning that this figure has dropped. The rise in the profits of the industrialists came from the positive effect of opportunities in non-operating profits. However, the profits stemming from industry, which is the main operation, should never be pushed to the background."

Bahçıvan also pointed to the problems stemming from the dominant use of low-tech in industry, emphasizing that companies should opt for technology and added value.

De-industrialization

Industry has been losing its dominance in the general economy for the past 15 years and this is continuing. In the first quarter of 2015, in an economy which grew 2.3 percent, the growth of the manufacturing industry was 0.8 percent. This was an indication of the "quality of growth" which had been mentioned many times before.

Growth was predominantly consumer-based. The İSO head said, "Anybody who considers the future of Turkey should be able to see this vicious circle. Decision makers and us industrialists should break this and reverse it. It is observed that our industrialists have been defeated by the pressure of the foreign exchange rate and finances."

Effect of inflation

Total sales of companies in 2014 went up 3.9 percent to 473 billion liras, but when it was reminded that 8.2 percent of this increase remained under the inflation rate of 2014, there was a drop in real sales.

When operating profits are reviewed, the performance of the top 500 companies fell compared to the previous year. In 2013, the top 500 had increased their operating profits to 8 percent; in 2014, the operating profit rate dropped to 6.4 percent.

Last year, industrial enterprises spent almost half of the profits they obtained from their main operating areas for their financing expenses. In 2013, the top 500 companies had nearly 36.5 billion liras of operating profits, spending more than half of it, some 19 billion liras in financings expenses. In 2014, the top 500 companies look as if they lost more than half of their 30 billion operating income, with 16 billion liras in financing expenses.

Dropping profits

Bahçıvan drew attention to the sustainability issue, saying, "Despite the drop in profitability, it is appreciated that our industrialists maintain their desire and struggle to produce but I want to point out that this is not sustainable." He said it was difficult for Turkey to reach its desired aims, to be competitive and to be able to invest with an operating profitability of around 6 percent.

Construction against industry

The effect of construction-oriented growth on the loss of blood in industry is of course being discussed. The İSO head said, "As industrialists, we are not against construction or builders; we are against the fact that everybody has become builders. It is indeed true that in a country such as Turkey, the correctly built construction does bring an added value to industry; however, the increasing trend of abandoning industrial operations to take up construction is concerning us in terms of the future of Turkey and the sustainability of both industry and construction."

In Turkey everybody agreed an economic growth model based on industry should be started, Bahçıvan said, adding, "We hope that this agreement turns into practice. We are not against construction but we argue that it is not for the good of Turkey to give up on industrial expertise and shift to different sectors."

2015 estimates

Bahçıvan said, "Extremely negative financial factors and also the fact that we were in an election year in the first half of 2015 as well as negative developments in the world conjuncture, prevent us, unfortunately, from being hopeful for the rest of 2015. I don't think the second quarter will be any different than the first quarter. Even though certain circles uphold the estimation of over 3 percent growth in 2015, we are observing a risk of lower than last year's growth for 2015. The state of affairs points to a growth of around 2 percent for Turkey in 2015."

Turkey has to show, in this period, an example of conciliation, to do business over reconciliation, succeeding in obtaining productive results by evaluating different ideas in a pool, Bahçıvan said. "This is what suits the maturity of our democracy as well as the maturity of our political parties and our leaders. For this reason, this negotiation period should be watched with patience by all social circles. I want to emphasize that until the talks reach a certain maturity, an understanding approach should be adopted toward all political parties and its leaders," he said.

The top of the list

Heading the top 500 list, TÜPRAŞ sat first with its sales from production figure of 37.5 billion liras, having increased its net sales 3.9 percent to 473 billion liras compared to 2013. The top companies were dominantly from the petrochemical, automotive and iron-steel sectors, with Ford Automotive coming second with its 10.5 billion liras in sales from production and Oyak- Renault third, after coming in fourth the previous year, with its sales figure of 8.77 billion liras.

(Graph) - Istanbul

Son Dakika › Güncel › Large İndustry Losing Blood - Son Dakika

Masaüstü bildirimlerimize izin vererek en son haberleri, analizleri ve derinlemesine içerikleri hemen öğrenin.

Sizin düşünceleriniz neler ?