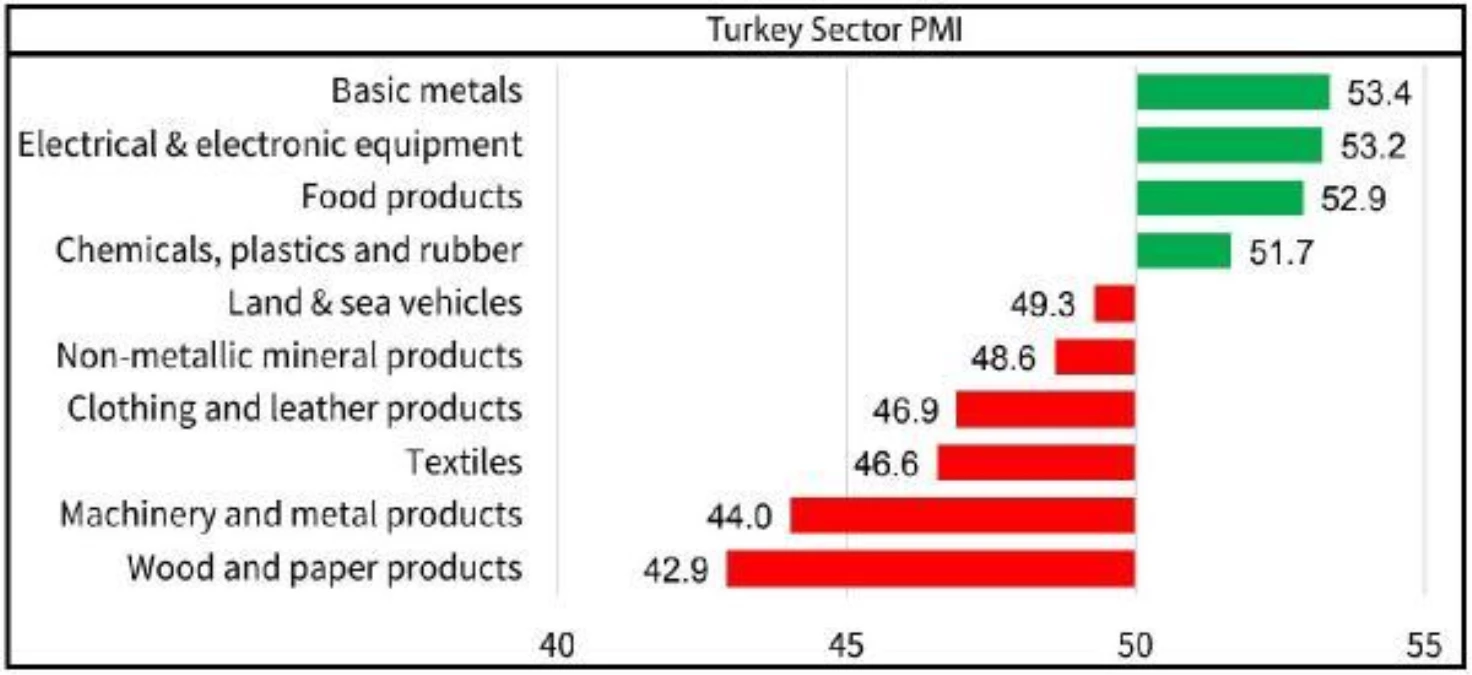

Seven of the ten monitored sectors saw output scaled back during May, with the wood and paper products, and machinery and metal products categories seeing the most marked slowdowns.

Growth was seen in food products, electronic & electrical equipment and basic metals. As was the case at the start of the first wave of the Covid-19 pandemic, food products were the best-performing sector in terms of output.

Commenting on the May survey results, Andrew Harker, Economics Director at IHS Markit said: "The Covid-19 lockdown restrictions in Turkey impacted the relative performance of sectors in May. As we saw with the first wave of the pandemic, essentials such as food products became more in demand, while other areas including textiles and clothing and leather products struggled. "Improvements were also seen in sectors such as basic metals and electronic & electrical equipment, where demand globally has been exceeding supply in recent months and is likely to remain elevated as global manufacturing ramps up."With restrictions now easing in Turkey, firms will be hoping to see a repeat of the sort of broad-based recovery that we witnessed during the middle of 2020."The majority of sectors struggled to generate growth amid the Covid-19 lockdown that was in place in Turkey through much of May. Slowdowns in new orders were also widespread, despite some pockets of improvement. Meanwhile, supply-chain disruption continued and rates of inflation remained marked.A similar picture was seen with regards to new orders, with growth led by food products but restricted to just four of the ten sectors. The sharpest moderation was in machinery and metal products.Employment trends generally remained positive, with staffing levels up across eight of the ten sectors, the exceptions being wood and paper products, and clothing and leather products. The strongest pace of job creation was in the basic metals category. Lengthening suppliers' delivery times continued to be seen across the board, with the worst disruption seen in the basic metals and electronic & electrical equipment sectors.Difficulties securing inputs added to inflationary pressures, with currency weakness also leading to higher prices. Rates of input cost inflation remained marked, although most sectors saw a softer increase in input prices than in April. Basic metals posted the fastest rise in cost burdens.The sharpest pace of output price inflation was in the machinery and metal products category, where the rise was the fastest in the year-to-date. The slowest inflation was in clothing & leather products where moderation of new orders impacted pricing power. (Graph)

Son Dakika › Güncel › ISO Turkey Sector PMI-Seven of 10 sectors' output fell in May - Son Dakika

Masaüstü bildirimlerimize izin vererek en son haberleri, analizleri ve derinlemesine içerikleri hemen öğrenin.

Sizin düşünceleriniz neler ?